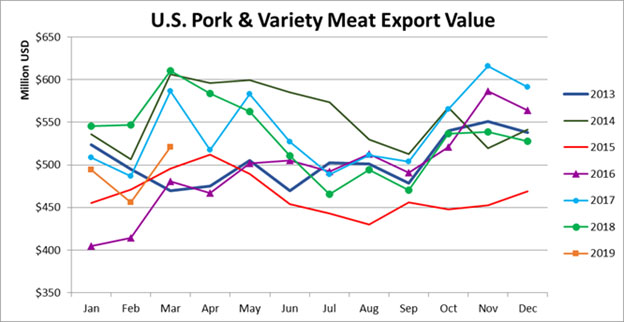

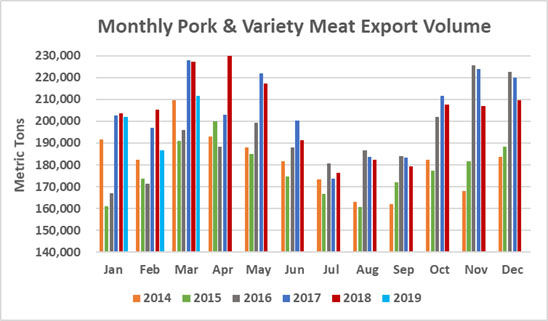

Pork Highlights March 2019:

Pork: 173,926 mt, -4%, $448 million, -11%

PVM: 37,762 mt, -19%, $72 million, -33%

Pork + PVM: 211,688 mt, -7%, $521 million, -15%

January – March 2019:

Pork: 486,705 mt, -5%, $1.243 billion, -12%

PVM: 113,563 mt, -10%, $227 million, -22%

Pork + PVM: 600,268 mt, -6%, $1.471 billion, -14%

March pork muscle cut exports were down 6,600 mt from last year as higher exports to South America (+3,850 mt), Canada (+2,900 mt), Aus/NZ (+2,300 mt), Taiwan (+1,500 mt), Caribbean + DR (+560 mt), China/HK (+418 mt), Central America (+250 mt), the ASEAN (+220 mt), and Africa (+130 mt) were outweighed by lower exports to Korea (-8,200 mt), Mexico (-7,800 mt), Japan (-2,800 mt), and the EU (-150 mt). The retaliatory tariffs continued to hit export values, with exports to Mexico down 14% in volume but down 27% in value, and exports to China/HK up 3% in volume but down 15% in value. Exports to Mexico were up from 42,807 mt in February to 47,166 mt in March. Exports to China/HK totaled 15,331 mt, with exports to China at 14,288 mt, up 9% and the highest since last April, and exports to HK at 1,043 mt, down 43% from last year but the highest since December. Exports were lower to Japan (30,130 mt, -9%) and Korea (19,210 mt, -30% but the highest so far this year). Exports to Canada (19,825 mt, +17%) were the highest since 2012, and exports to Taiwan (2,040 mt, +262%) were the highest since 2010. Exports to Australia and markets in South and Central America continued to outpace last year’s record levels in March: Australia (9,190 mt, +31%), Colombia (9,450 mt, +15%), Chile (2,910 mt, +55%), the DR (+4,400 mt, +11% and the third highest monthly volume), and Honduras (2,330 mt, +17%). Exports to the Philippines also increased (2,513 mt, +18%).

In March, pvm exports were down 9,100 mt from last year. Exports to top market China/HK (-7,300 mt) were down 27% in volume and down 42% in value. Exports were also lower to the ASEAN (-810 mt), Taiwan (-430 mt), Mexico (-310 mt), Korea (-230 mt), Africa (-160 mt), Japan (-100 mt), while exports were higher to South America (+110 mt) and Central America (+110 mt). Exports to China/HK totaled 19,975 mt, down 27% from last year but the highest since last May. Exports to China were 13,191 mt, down 15% and the highest since last April, while exports to HK were 6,784 mt, down 42%. Exports were lower to Mexico (10,824 mt, -3%), Korea (1,146 mt, -16%), Japan (909 mt, -10%), the Philippines (540 mt, -65% and the lowest volume since 2016), and Taiwan (344 mt, -56%), while exports were higher to Canada (1,810 mt, +3%), Chile (671 mt, +18%), and Guatemala (252 mt, +81%).

For January – March, total pork and pvm exports were down 36,000 mt from last year. Exports were higher to South America (+11,900 mt), Aus/NZ (+7,100 mt), Canada (+4,400 mt), Taiwan (+3,000 mt), Central America (+2,300 mt), Caribbean + DR (+1,900 mt), the ASEAN (+1,200 mt), and the Russia region (270 mt). Exports were lower to Mexico (-26,200 mt), China/HK (-22,000 mt), Korea (-10,950 mt), Japan (-8,900 mt), the EU (-270 mt), and Africa (-160 mt).

March pork exports accounted for 22.7% of pork production and 25.6% when including variety meats, down from 23.5% and 27.5% for March 2018. For January – March, pork exports accounted for 21.3% of production and 24.4% when adding variety meats, down from 23.0% and 26.6% last year.

March pork export value per head averaged $48.55/head, down $8.36/head or -15% from $56.91/head for March 2018. For January – March, pork export value per head averaged $46.15/head, down $8.66/head or -16% from $54.81/head last year.

SOURCE: USMEF