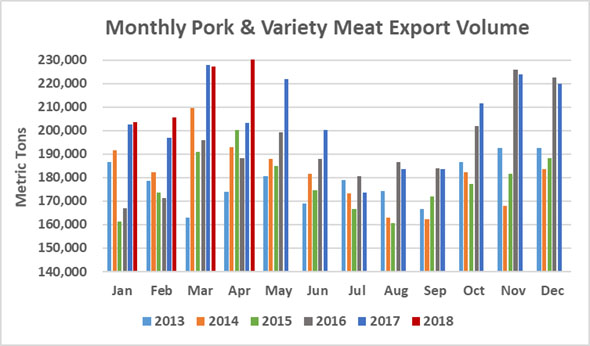

US pork export statistics: April 2018

Pork Highlights:

April

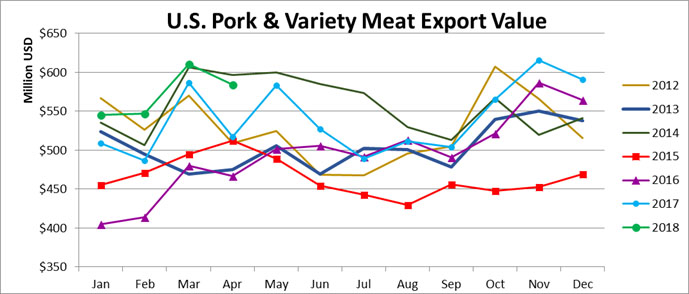

Pork Exports: 184,487 mt, +18%, $481 million, +14%

PVM Exports: 45,562 mt, -4%, $103 million, +8%

Pork + PVM Exports: 230,049 mt, +13%, $584 million, +13%

January – April

Pork Exports: 694,360 mt, +9%, $1.891 billion, +10%

PVM Exports: 171,986 mt, -10%, $396 million, +5%

Pork + PVM Exports: 866,346 mt, +4%, $2.287 mt, +9%

Both pork muscle cut exports and total pork/pvm exports were record large in April, driven by a large monthly total to Mexico. The pork muscle cut record was driven mostly by Mexico, with pork muscle cut exports to Mexico at 66,685 mt, the second highest on record after Dec 2016, and up nearly 20,000 mt from last April.

The other main growth markets were Korea (+10,000 mt), Central America (+2,000 mt), South America (+1,900 mt), and Australia/NZ (+1,000 mt). Pork exports to Korea were 23,973 mt, the third highest on record after March 2018 and March 2011.

Exports were higher to all Central American markets in May, with Honduras up 620 mt from last April and Panama up 430 mt.

Higher exports to South America were driven by Colombia, as exports slowed to Chile in April. Exports to Colombia were down from March’s large total but were still up 2,700 mt from last year at 7,300 mt in April.

Exports were also higher to the ASEAN (+240 mt), the Caribbean +DR (+130 mt), and the EU (+100 mt). Exports were lower to China/HK (-2,900 mt), Japan (-1,800 mt), Canada (-1,200 mt), Taiwan (-580 mt), Russia Region (-150 mt), and Africa (-130 mt). Exports direct to China were 14,500 mt, the highest since last May and up 1,000 mt from last April. Exports to HK maintained the low level set in March at 1,900 mt, down nearly 4,000 mt from last year. Exports to Japan were 30,100 mt, the lowest so far this year.

PVM exports to China/HK were down 4,000 mt or -14% in April, although value was still up 1%. PVM exports to China were 14,200 mt, down 14% or -2,400 mt from last year. Exports to HK were 11,100 mt, down 13% or -1,600 mt from last year.

PVM exports were higher to most other markets with the biggest growth for Korea (+920 mt), the ASEAN (+430 mt), Central America (+350 mt), Japan (+300 mt), Mexico (+260 mt), and Taiwan (+240 mt). Mexico is by far the second largest market for PVM exports after China/HK, and exports to Mexico were 12,300 mt, the highest since January. Exports to Korea were the largest since April 2014 at 1,400 mt. The growth in the ASEAN was from the Philippines, with exports to the Philippines at 1,300 mt. Exports to Central America were 800 mt, with growth driven by Guatemala, Honduras, and Costa Rica.

For January – April pork/pvm exports, volumes were higher for Korea (+29,100 mt), Mexico (+17,600 mt), South America (+7,300 mt), Central America (+4,900 mt), the ASEAN (+2,500 mt), Aus/NZ (+1,800 mt), the Caribbean + DR (+1,800 mt), Taiwan (+700 mt), and the EU (+300 mt). Exports were lower to China/HK (-26,200 mt), Canada (-2,800 mt), Japan (-1,600 mt), Russia Region (-400 mt), and Africa (-100 mt).

April pork exports accounted for 25.8% of pork production and 29.9% when including variety meats, compared to 23.5% and 28.4% last April. For Jan – Apr, pork exports accounted for 23.7% of production and 27.4% when adding variety meats as compared to 22.8% and 27.5% last year.

April pork export value per head averaged $58.45/head, up $3.06/head or 6% from $55.39/head last year. Jan – Apr export value per head averaged $55.69/head, up $2.57/head or 5% from $53.12/head last year.

SOURCE: USMEF