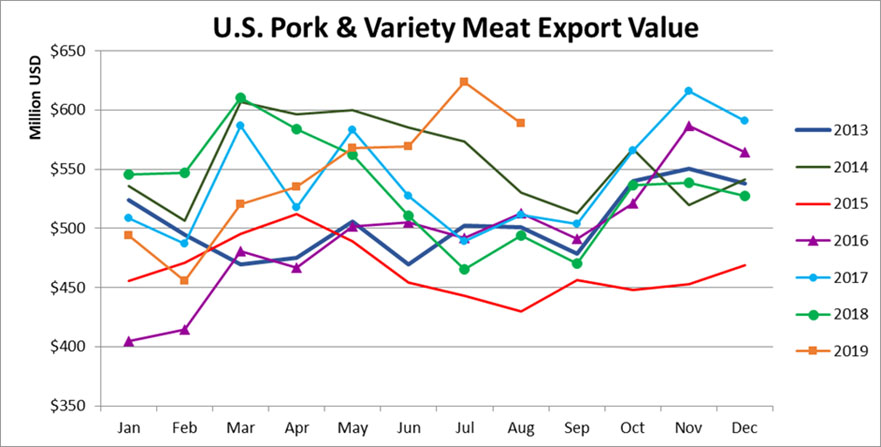

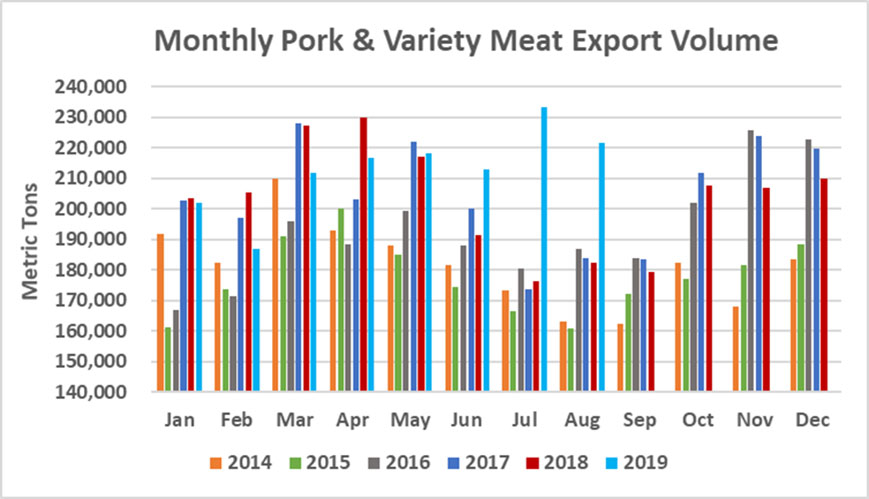

Pork Highlights August 2019:

Pork: 178,721 mt, +20%, $503 million, +21%

PVM: 42,865 mt, +27%, $85.5 million, +8%

Pork + PVM: 211,586 mt, +22%, $589 million, +19%

January – August 2019:

Pork: 1.376 million mt, +5%, $3.710 billion, +4%

PVM: 326,549 mt, +2%, $645 million, -13%

Pork + PVM: 1.703 million mt, +4%, $4.355 billion, +1%

For pork, those are definitely massive volumes for July-Aug and China was the volume driver but it is encouraging to see that Aug exports were still higher than last year for Korea, South America (Colombia and Chile), Australia and New Zealand and Central America. Thus far the growth to China has not come at the expense of these other growth markets.

Exports to China/HK were down modestly from the July record (68,657 mt in July and 63,656 mt in Aug). Variety meat volume held above 24k mt as has been the case since May. Pork cuts were close to 39k mt (and about as forecast!), down from 44,5k in July and obviously dramatically higher than the 6k a year ago. We expect China/HK pork cut volume to range from 35k-45k per month for Sept-Dec.

Exports to ASEAN were the biggest this year, but still below year-ago, as larger exports to the Philippines didn’t fully offset smaller exports to VN.

Exports to the DR continued below year-ago and have been negatively impacted by relatively higher prices for trimmings, etc.

Exports to Mexico were still below year-ago in Aug, suggesting the lingering damage of the tariffs. But unit export values were up 21% compared to last year as prices started to normalize with improved demand from both Mexico and China.