Monthly U.S. Pork & Variety Meat Export Volume in January 2022

Pork Highlights

January 2022:

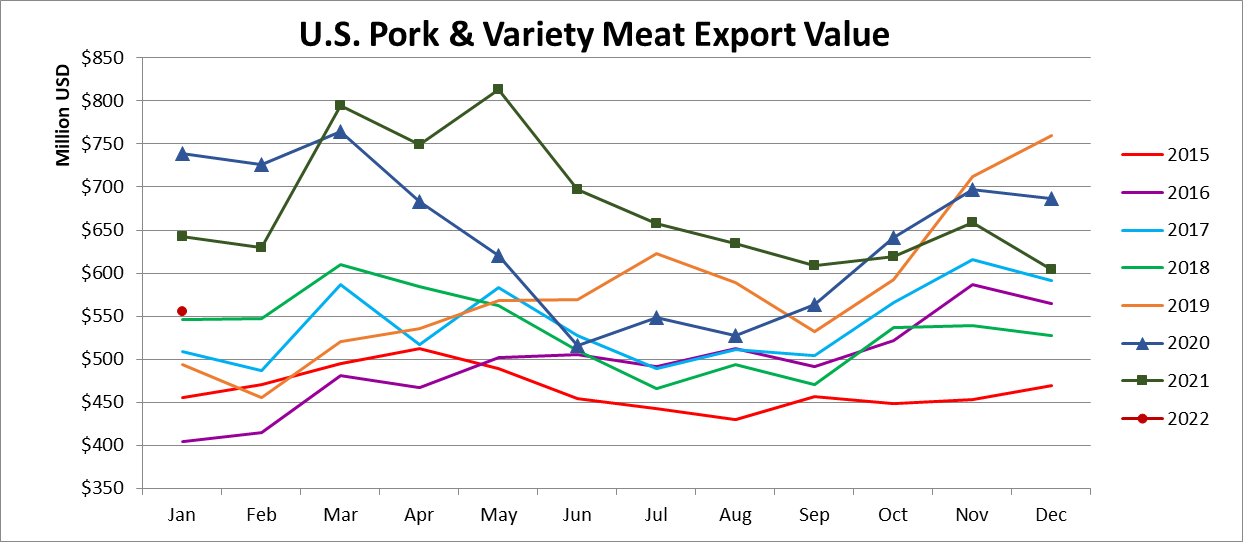

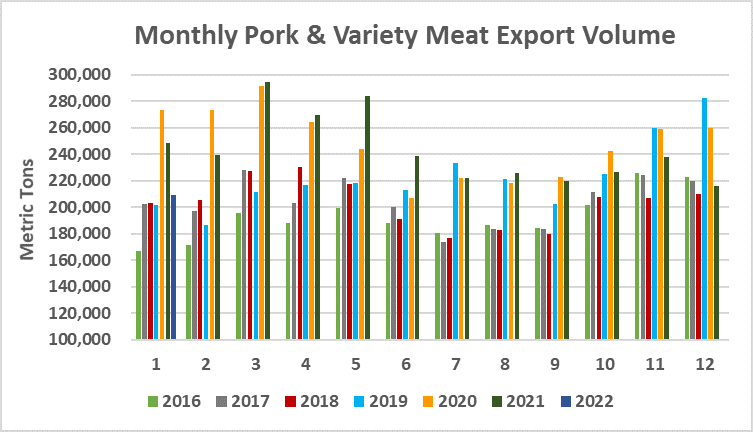

Pork: 173,687 mt, -17%, $462 million, -16%

PVM: 35,121 mt, -13%, $94 million, 2%

Pork + PVM: 208,808 mt, -16%, $556 million, -14%

January pork muscle cut exports totaled 173,687 mt, the lowest since last July and down 17% or -34,550 mt from last year (export volume was down 26% from Jan 2020 but up 8% from Jan 2019). Compared to last year, January pork muscle cut export volumes were higher to Mexico (+24,500 mt) and the Caribbean + DR (+670 mt). Exports were lower to China/HK (-37,600 mt), Japan (-6,400 mt), Australia/NZ (-5,500 mt), Canada (-2,600 mt), ASEAN (-2,550 mt), South America (-2,400 mt), Central America (-1,800 mt), Taiwan (-290 mt), and Korea (-220 mt). Pork muscle cut exports set a new record to Mexico (78,538 mt, +45%) in January, up 6% from the Q4 2021 record. Exports to Japan (25,512 mt, -20%) slowed to the lowest level since June 2020, while exports to Korea (15,274 mt, -1%) were down just slightly year-over-year and were the highest since May. Exports to Canada (13,788 mt, -16%) were the lowest since May 2020. Combined exports to China/HK totaled 14,124 mt, down 73% from last year. Exports were up 5% from December but were otherwise the lowest since February 2019. Exports were lower to both China (13,335 mt, -74%) and Hong Kong (789 mt, -14%). Exports to the Dominican Republic (5,862 mt, +13%) were the second highest on record after 6,345 mt in March of last year. Exports slowed to Honduras (3,074 mt, -12%). Guatemala (1,686 mt, -27%), Panama (1,276 mt, -27%), and Nicaragua (489 mt, -58%), but exports were higher to Costa Rica (1,132 mt, +12%) and El Salvador (1,029 mt, +24%). Exports to Colombia (5,765 mt, -9%) were the lowest since June 2021, following record volumes in Q4 2021, and exports to Chile (546 mt, -79%) were the lowest since 2017. Exports to Peru (307 mt, +142%) were up from last year but remained below pre-covid levels. Exports to Australia (1,969 mt, -72%) were up 24% from December’s low level but were otherwise the lowest since 2014, and exports also slowed to New Zealand (256 mt, -63%). Exports to the Philippines (1,209 mt, -63%) rebounded from the recent lows in November and December but remained below year-ago levels, and exports to Singapore (180 mt, -46%) were also lower year-over-year. Exports continued to rebound to the Bahamas (450 mt, +9%).

January pork variety meat exports were down 13% from last year at a total of 35,121 mt , up 0.1% from December and otherwise the lowest since July 2020. January pork variety meat exports were higher year-over-year to Japan (+560 mt), Caribbean + DR (+450 mt), Central America (+140 mt), and Korea (+70 mt), while exports were lower to China/HK (-3,100 mt), South America (-1,300 mt), Mexico (-1,200 mt), ASEAN (-480 mt), Australia/NZ (-220 mt), Taiwan (-110 mt), and Canada (-80 mt).

Combined exports to China/HK totaled 21,332 mt, up 4% from December but otherwise the lowest since February of last year and down 13% year-over-year on lower exports to China (21,212 mt, -12%) and Hong Kong (120 mt, -73%). Exports to Mexico (8,489 mt, -12%) slowed to the lowest level since September 2020, and exports were also lower to Canada (1,263 mt, -6%). Exports slowed to the Philippines (1,044 mt, -28%). Exports to Japan (940 mt, +145%) were the highest since June 2019, and exports to the Dominican Republic (546 mt, up significantly) were the highest since 2009. Exports were also higher to Guatemala (404 mt, +49% and the highest since 2019) and Honduras (121 mt, +32%).

January pork exports accounted for 22.8% of pork production and 25.5% when including variety meats as compared to 25.2% and 27.9% for January 2021.

January 2021 pork export value per head averaged $53.37/head, down $3.76/head or -7% from $57.14/head in January 2021.

SOURCE: USMEF